April 2019

April 1, 2019

FTZ’ine June 2019

June 3, 2019Down To The Wire

Although the 2020 Presidential election may seem far off at the moment, it is already having an impact on the Congressional schedule for legislation, including trade agreements. Just one month ago, President Trump told lawmakers that he is intent on trying to get a new trade agreement between the United States, Mexico, and Canada implemented before the end of 2019. This was one of his key campaign pledges in the 2016 cycle, and he may view fulfilling that promise as essential to re-election.

Estimates of the number of Democratic votes required to pass such a bill in the House range from 30 – 100, a tall order in today’s charged political climate. Not to mention the enormous task of getting it to the House floor for a vote. The Administration may need to apply additional pressure to get that support, which has already come in the form of special tariffs on Mexican and Canadian steel and aluminum, the threat of quotas, and consideration and reconsideration of numerous anti-dumping measures. What other incentives might the President create to get Congress, and his Mexican and Canadian counterparts, to enact the USMCA yet this year? The next couple of months could be very active ones for the international trade community. Stay tuned.

Top Story: As Parting Gift Japanese Prime Minister Builds Auto Plant . . . In Canada

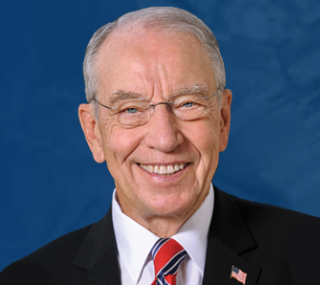

Grassley says Mexico and Canada Tariffs Must Come Off For USMCA Passage

Chinese President Expected Soon, Foreign-Trade Deal Details Still Unclear

Commerce Gives Mexico a Rotten Tomatoes Score of 0

U.S. Economy Posts Strong 1st Quarter, Easing Global Recession Fears For Foreign-Trade Zones

U.S. Foreign-Trade Zones Board Activity

- LNK International, Inc., received authorization of production activity for Pharmaceutical Products in Foreign-Trade Zone 52 in Hauppauge, New York. MORE

- Patheon Softgels received authorization of production activity for Pharmaceutical Products in Foreign-Trade Zone 230 in Greensboro, North Carolina. MORE

- CGT U.S., Ltd., submitted a notification of proposed production activity for Polyvinyl Chloride (PVC) Coated Upholstery Fabric Cover Stock in Foreign-Trade Zone 80 in San Antonio, Texas. MORE

- ProAmpac Holdings, Inc., submitted a notification of proposed production activity for Flexible Packaging Applications in Foreign-Trade Zone 167 in Green Bay, Wisconsin. MORE

- Offshore Energy Services, Inc., submitted an application to operate its Gramercy, Louisiana facility as a subzone of Foreign-Trade Zone 124. MORE

- Swagelok Company received approval for the expansion of subzone 40I in Ravenna, Ohio. MORE

- An application has been submitted for the expansion of Foreign-Trade Zone 116 in Port Arthur, Texas. MORE

- WPG Americas Inc. received approval for subzone status for subzone 262D in Southaven, Mississippi. MORE

- Gulf Coast Growth Ventures LLC received authorization of production activity for Ethylene, Polyethylene and Monoethylene Glycol and Related Co-Products in Foreign-Trade Zone 122 in Corpus Christi, Texas. MORE

- Electrolux Home Products, Inc., submitted a notification of proposed production activity for Appliances in Foreign-Trade Zone 38 in Mount Pleasant, South Carolina. MORE

- GDI Technology, Inc., submitted an application for subzone status for its facility in Foreign-Trade Zone 281 in Miami, Florida. MORE

- Airbus OneWeb Satellites, LLC, submitted a notification of proposed production activity for Satellites and Satellite Systems in Foreign-Trade Zone 136 in Brevard County, Florida. MORE

- Cheniere Energy Partners, L.P., submitted a notification of proposed production activity for Liquified Natural Gas in Foreign-Trade Zone 291 in Cameron Parish, Louisiana. MORE

- Tesla, Inc., received approval to expand subzone 18G in Livermore, California. MORE

- Calsonic Kansei North America received authorization of production activity for Automotive Parts in Foreign-Trade Zone 158 in Jackson, Mississippi. MORE

- Panasonic Eco Solutions Solar New York America received authorization of production activity for Crystalline Silicon Photovoltaic Cells in Foreign-Trade Zone 158, Subzone 23E, in Buffalo, New York. MORE

- Calsonic Kansei North America received authorization of production activity for Automotive Parts in Foreign-Trade Zone 78 in Nashville, Tennessee. MORE

- EBI, LLC., submitted a notification of proposed production activity for Mattresses and Sofas in Foreign-Trade Zone 238 in Dublin, Virginia. MORE

- Samsung Electronics America, Inc., submitted a notification of proposed production activity for Packaging for Mobiles and Tablets in Foreign-Trade Zone 168 in Dallas, Texas. MORE

- GE Renewables North America, LLC, submitted a notification of proposed production activity for Wind Turbine Nacelles, Hubs, and Drivetrains in Foreign-Trade Zone 249 in Pensacola, Florida. MORE

- Thoma-Sea Marine Constructors, L.L.C., received approval to expand subzone 279A in Huoma and Lockport, Louisiana. MORE

- Lexmark International, Inc., received approval for subzone status for its facility in Longmont, Colorado. MORE

- Bloom Energy Corporation received authorization of production activity for Commercial Fuel Cells and Related Subassemblies in Foreign-Trade Zone 18 in San Jose, California. MORE

- Driftwood LNG, LLC, received authorization of production activity for Liquified Natural Gas Processing in Foreign-Trade Zone 87 in Lake Charles, Louisiana. MORE

Down To The Wire

Although the 2020 Presidential election may seem far off at the moment, it is already having an impact on the Congressional schedule for legislation, including trade agreements. Just one month ago, President Trump told lawmakers that he is intent on trying to get a new trade agreement between the United States, Mexico, and Canada implemented before the end of 2019. This was one of his key campaign pledges in the 2016 cycle, and he may view fulfilling that promise as essential to re-election.

Estimates of the number of Democratic votes required to pass such a bill in the House range from 30 – 100, a tall order in today’s charged political climate. Not to mention the enormous task of getting it to the House floor for a vote. The Administration may need to apply additional pressure to get that support, which has already come in the form of special tariffs on Mexican and Canadian steel and aluminum, the threat of quotas, and consideration and reconsideration of numerous anti-dumping measures. What other incentives might the President create to get Congress, and his Mexican and Canadian counterparts, to enact the USMCA yet this year? The next couple of months could be very active ones for the international trade community. Stay tuned.