December 2018

November 29, 2018February 2019

February 1, 2019We Interrupt This Broadcast . . .

The FTZine Staff wants to wish all of our readers a Happy New Year! 2019 is shaping up to be another big year for trade, with major U.S. negotiations taking place with the world’s largest economies including China, Japan, Canada, and Mexico. Amid all of those discussions, the federal government needs to find a way to restart as a shutdown has closed many “non-essential” functions that are essential for FTZs. This interruption of services may mean a rocky start to the new year for operating zones as discussed in this issue.

Top Story: Government Shutdown Has Direct Impact on FTZs

Arriving back at the Capitol this week, Senate Majority Leader Mitch McConnell said there was no new progress towards ending the current federal government shutdown. In the meantime, agency closures will have a significant impact on FTZs

At the top the list is the closure of the U.S. Foreign-Trade Zones Board. No action will be taken with respect to any FTZ applications or administrative actions submitted to the Board. Don’t bother trying to get a jump on your 2018 Annual Report either - the website is even shut down.

ACE is operational but help desk support is uncertain and most ABI client representatives appear to be furloughed. This has caused issues as a revised HTSUS went into effect yesterday and includes some technical changes that caught zones off guard.

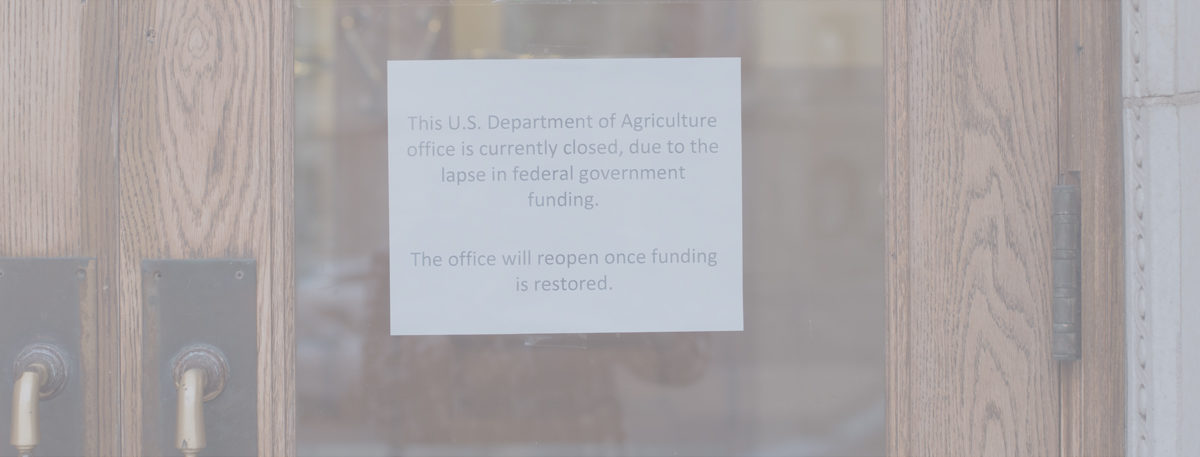

As shown in our lead photo, the shutdown list also includes USDA, which regulates imports of wood and other agricultural products. At least portions of the International Trade Commission (ITC) and the Department of Justice are also on furlough.

President Tweets China Negotiations “Are Going Well”

TPP Marches On Without U.S. – Will FTZ Exports See Impact?

Japan Forges Trade Agreement With EU. Will the US Be Next?

CBP, Under pressure, Publishes Final Rule for TFTEA Drawback

U.S. Foreign-Trade Zones Board Activity

- Fluid Equipment Development Company, LLC submitted a notification of proposed production activity for energy recovery turbines and centrifugal pumps in Foreign-Trade Zone 70 in Monroe, Michigan. LEARN MORE

- Tesla, Inc., received authorization for production of electric passenger vehicles and components in Foreign-Trade Zone 18G in San Jose, California. LEARN MORE

- Mayfield Consumer Products received approval to operate its Mayfield and Hickory, Kentucky facilities as Subzone 294A. LEARN MORE

- Winpak Heat Seal Corporation received approval to operate its Pekin, Illinois facility as Subzone 114G. LEARN MORE

- adidas America, Inc., submitted an application requesting subzone status for its facility in Foreign-Trade Zone 24 in Wilkes-Barre, Pennsylvania. LEARN MORE

- Generac Power Systems, Inc., received authorization for production of outdoor power equipment, pumps, and lawn and garden equipment in Subzone 41J, in Jefferson and Whitewater, Wisconsin. LEARN MORE

- BAUER-Pileco Inc., received approval to operate its Conroe, Texas facility as Subzone 84Z. LEARN MORE

- Schumacher Electric Corporation received approval to operate its Fort Worth, Texas facility as Subzone 168F. LEARN MORE

- Helix Steel received authorization for production of twisted steel micro rebar in Foreign-Trade Zone 189 in Grand Rapids, Michigan. LEARN MORE

- Gulfstream Aerospace Corporation submitted a notification of proposed production activity for disassembly of aircraft in Foreign-Trade Zone 168E in Dallas, Texas. LEARN MORE

- Bloom Energy Corporation submitted a notification of proposed production activity for commercial fuel cells and related subassemblies in Foreign-Trade Zone 99I in Newark, Delaware. LEARN MORE

- CODEZOL, C.D. received approval to include a site at the Ponce Regional Distribution Center (Site 17) within Foreign-Trade Zone 163 in Ponce, Puerto Rico. LEARN MORE

- The Ellis County Trade Zone Corporation received approval to expand the alternative site framework service area of Foreign-Trade Zone 113 to include Navarro County, Texas. LEARN MORE

- The Metropolitan Government of Nashville and Davidson County received approval to reorganize Foreign-Trade Zone 78 under the alternative site framework in Nashville, Tennessee with a service area including the Counties of Cannon, Cheatham, Davidson, Dickson, Macon, Maury, Montgomery, Robertson, Rutherford, Smith, Sumner, Trousdale, Williamson and Wilson, Tennessee . LEARN MORE

- Puerto Rico Steel Products Corporation submitted an application for subzone status for its 14.57 acre facility within Foreign-Trade Zone 163 in Coto Laurel, Puerto Rico. LEARN MORE

- The Lewiston-Auburn Economic Growth Council filed an application to expand the ASF service area of Foreign-Trade Zone 263 to include York County, Maine. LEARN MORE

We Interrupt This Broadcast – The FTZine Staff wants to wish all of our readers a Happy New Year! 2019 is shaping up to be another big year for trade, with major U.S. negotiations taking place with the world’s largest economies including China, Japan, Canada, and Mexico. Amid all of those discussions the federal government needs to find a way to restart as a shutdown has closed many “non-essential” functions that are essential for FTZs. This interruption of services may mean a rocky start to the new year for operating zones.