FTZ’ine August 2025

August 5, 2025

FTZ’ine October 2025

October 1, 2025One Down, One To Go

The first appeal of the lawsuit challenging President Trump’s IEEPA tariffs ended in favor of the plaintiffs. Now the Supreme Court will have the final say if U.S. reciprocal tariffs stay in place as they are, or need to be rescinded with monies refunded. There are many options left to the Administration to replace the revenue lost, so it can be hard to say what outcome foreign-trade zones should be looking for from the nation’s highest court.

Most foreign-trade zones are struggling to adjust to the additional reporting requirements from Section 232. Hundreds of product classifications were quickly added to the list of steel and aluminum derivative products, setting off an international scramble for product and invoice details never needed before.

Rising bond requirements are crushing importers, and requests for cash collateral to permit import activity are on the rise.

Staff actions by the U.S. Foreign Trade Zones Board continue at a blistering pace. Timelines for approval are extended however, especially for Production Notifications. Apply early, but not often.

Top Story: IEEPA Tariffs Against The Ropes

Just before the holiday weekend, the U.S. Court of Appeals for the Federal Circuit affirmed an earlier ruling from the Court of International Trade (CIT) that President Trump’s tariffs based on IEEPA were illegal.

The new ruling was different from the first. While a 7-4 majority ruled that the breadth of the tariffs the president had imposed was illegal, the CIT ruling had been unanimous. The latest judges to hear the case also raised the possibility that any benefits from the suit would apply only to the plaintiffs, not to importers in general.

The Court of Appeals postponed implementation of its findings until mid-October, giving the Trump administration only a short window for resolving the matter at the Supreme Court. The appeal has already been filed.

Foreign-trade zone operators and users are wondering if a Supreme Court ruling in favor of the importers in the case will lead to the return of NPF status and traditional duty rates. The answer is:

Maybe.

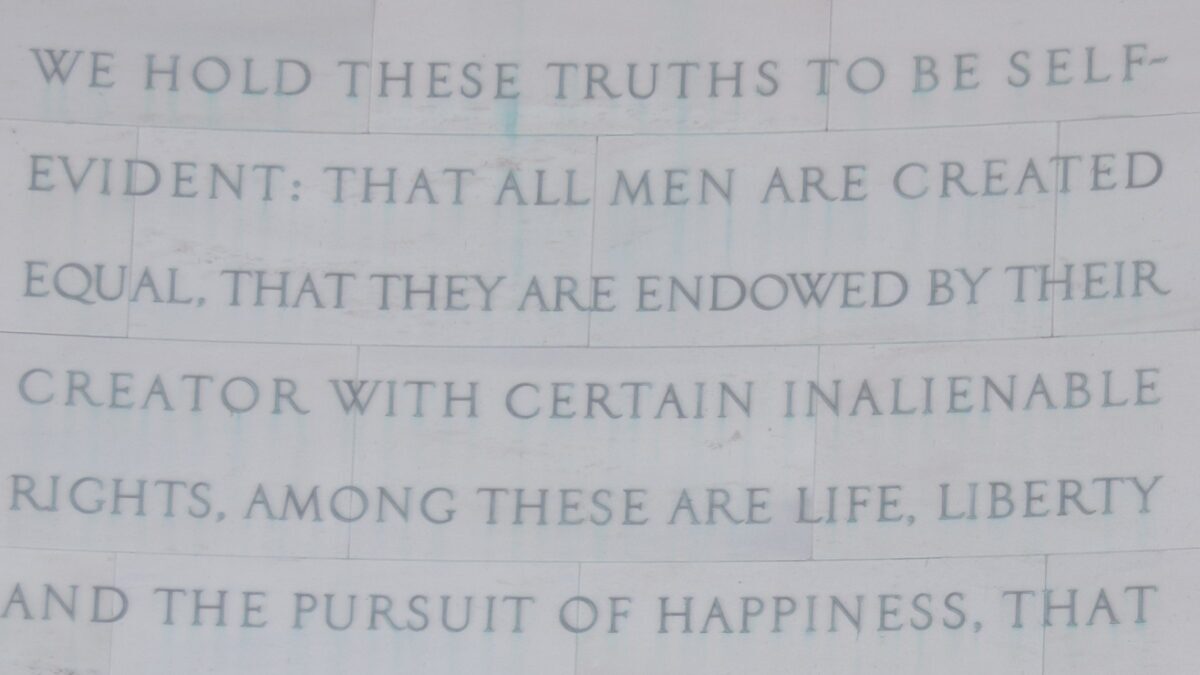

President Trump’s reciprocal tariff strategy is currently based on powers granted to him by Congress in the International Emergency Economic Powers Act, known as IEEPA. Previous presidents have typically applied the law with sanctions and embargoes against other nations, not tariffs.

The IEEPA law does not even mention the word tariff, and the power to raise revenue is specifically granted to Congress in the Constitution. The President had invoked his powers under IEEPA to combat persistent trade deficits and the flow of fentanyl into the United States.

Hours before the ruling, the president’s top economic advisers raised special concern about the fate of the trade agreements the United States had struck with other governments. Among the deals they cited was the agreement with the European Union, which made favorable concessions to escape even higher U.S. taxes on its goods.

The appeals court ruling implicates a vast set of tariffs, some of which date back to the beginning of Mr. Trump’s presidency. They include some of his toughest duties on China, Canada and Mexico, and his so-called reciprocal tariffs, which Mr. Trump later revised and began collecting this month.

Without IEEPA, the president would be limited in the duties he could apply, and the manner and speed in which they could be imposed. Otherwise, he could seek to enact tariffs, or amend the IEEPA law, with the support of Congress.

The administration has no guarantee of success at the Supreme Court. Many leading conservative and libertarian lawyers and scholars have argued that the president’s duties were issued illegally.

Mr. Trump’s claims of seemingly unlimited trade power have elicited legal challenges from small businesses and states, which said they were harmed financially by taxes on foreign goods that the president had no right to issue. In May, a federal trade court agreed, invalidating many of the president’s duties on grounds that the law did not grant him “unbounded authority” to wage his global trade war.

“It seems unlikely that Congress intended, in enacting IEEPA, to depart from its past practice and grant the president unlimited authority to impose tariffs,” a majority of judges wrote in their ruling, citing the “magnitude” of the duties Mr. Trump had put in place.

It is still unclear whether businesses would see relief from the ruling. Even if Mr. Trump appeals to the Supreme Court and loses, he still retains significant tariff powers.

The available tools include a provision of trade law known as “Section 232,” which allows the president to impose duties related to national security. Mr. Trump has used this tool to impose duties on foreign cars and steel, and propose additional tariffs on semiconductors, pharmaceuticals and other products.

Other trade laws allow the president to issue more sweeping tariffs for a limited period of time. Section 122 of the Trade Act of 1974, for example, allows a president to impose duties of up to 15 percent globally for up to 150 days, and could be used as a temporary measure. Another provision of that law, known as Section 301, gives the president broad scope to issue tariffs in response to unfair trading practices, as long as the administration first carries out consultations and an investigation.

The President said the administration would ask the Supreme Court to render their decision on an “expedited” timeline.

CBP Finalizes de minimus End With International Mail Route Closure

Late last month CBP approved several parties to collect U.S. tariffs on international mail shipments. With a method for collecting tariffs on mail established, U.S. Customs closed the last loophole for avoiding duty payment on low value shipments.

The list of approved parties authorized to collect U.S. duty payments on mail currently stands at a dozen. The list just came out last week, and the national postal services of more than 30 countries have restricted U.S.-bound packages while they adjust to the new payment requirements. Those include the mail systems of Australia, New Zealand, India, Japan, Mexico, Thailand and most countries in Europe.

Purchases that previously entered the U.S. without needing to clear customs will require vetting and be subject to their origin country’s applicable tariff rate. For the next six months, mail carriers can instead apply a flat duty of $80 to $200 to packages sent through the global postal network. After that, both mailed parcels and those handled by private courier services will be subject to the value-based tariff rate.

The Executive Order ending de minimus is based on authority granted to the President under the International Emergency Economic Powers Act (IEEPA @ 50 U.S.C. 1701 et seq.) If the Supreme Court strikes down the President’s ability to raise revenue under IEEPA, it is not clear if the de minimus exemption would be reinstated until the Congressional deadline kicks in two years from now.

Questions about how the elimination of de minimus will affect your FTZ? Contact us at info@iscm.co.

India Pivot Complicates FTZ Trading Picture

India was supposed to be the alternative to China.

But earlier this week the Prime Minister of India posed for smiling photographs with the Presidents of Russia and China.

And now President Trump has deemed it “not a good trading partner.” After months of fruitless negotiations over details on soybean exports and trade surpluses, the President announced in July that India’s reciprocal tariff rate would be 25 percent. A week later, an additional 25 percent penalty was added because India still buys Russian crude oil used to fund the war against Ukraine.

Those tariffs took full effect last week, and importers are scrambling to adjust supply chains to try and mitigate the impact of the sudden cost increase.

When the full weight of the 50 percent U.S. tariff on Indian goods went into effect on Wednesday, the stock market in the Indian financial capital of Mumbai was closed. But market indexes there staggered in anticipation on Tuesday, losing a percentage point of value in their worst performance of the summer.

Huge parts of India’s economy are disconnected from world trade, and some products, like pharmaceuticals and smartphones, are exempt from the tariffs for now. But the parts of the economy that are affected by the U.S. levies include businesses that provide mass employment.

“At the moment, it’s a full stop” for India’s textile and garment industry, which accounts for millions of jobs and 2 percent of the country’s formal economy. American buyers built up inventories of fabric, shirts and pajamas in preparation for this shock, but new orders have come to a halt.

In addition to the prospect of distraught businesses and laid-off workers, Prime Minster Narendra Modi has another problem emerging on the horizon. If India is about to lose much of its $130 billion annual trade in goods with the United States — including both the cotton it buys and the bedsheets it sells — it will need to find new partners.

While China has the size to replace the United States as a trading partner, most Chinese investors in Indian businesses were kicked out of the country in 2020. This was in response to tensions at the Himalayan border that flared into a melee that killed 20 Indian soldiers.

Is A Bond Crisis Looming For FTZs And Other Importers?

Importer bond requirements are rising dramatically for foreign-trade zone users and other importers. The increased requirements are driven by higher tariffs which automatically increase the financial liability the bond must cover.

As bond requirements triple and quadruple overnight, some importers may not be able to post bonds in the amounts CBP requires, forcing Cash deposits, cutbacks in import activity, or adding even more costs to the import process.

When U.S. Customs finds a bond amount to be insufficient, you typically have only 30 days to file a new, larger bond. In cases of "gross insufficiency," CBP can terminate the bond with only 15 days' notice.

Importers will want to avoid increasing their bond amounts under pressure from CBP and monitor their duty exposure to make sure and have a limited time to file a new bond at a higher amount to avoid shipment delays or even termination of their bond. ACE Portal accounts can be very useful for this purpose, however some modeling or projecting will be required to take newly implemented tariffs into account. The CBP updated its bond directive in February 2024, which detail the guidelines for setting bond amounts.

The volatile tariff environment and changes in foreign trade policy have increased the risk for sureties as well. When bonds are changed frequently in response to changes in trade policy, liability can "stack" over multiple periods, meaning a single bond can cover multiple years of potential unpaid duties, further increasing the required amount. Sureties may require cash collateral from some importers to blunt the increased risk the new tariffs create.

Importers unable to meet the financial requirements for a new continuous bond may need to use more expensive single-entry bonds.

Foreign-Trade Zones Brace For October Port Fees On Chinese Vessels

New charges established by the U.S. Trade Representative (USTR) for Chinese-owned, operated, and built vessels will go into effect next month.

Chinese-owned or operated vessels will be charged based on the ship's net tonnage, starting at $50/net ton and increasing over three years to $140/net ton. Non-Chinese operators of Chinese-built vessels face lower fees, initially $18/net ton or $120 per container, which will also increase annually.

The rules cap the fee per vessel at five rotations annually and apply the charge only once per inbound voyage, not for every U.S. port call. Exemptions are in place for smaller ships and certain short-haul trades, so some operators will experience limited effects.

Even with the caps, the new fees that begin on October 14th may reorient shipping lanes and port calls as importers try to minimize the impact on supply chain costs.

The actual fee per container will depend on the number of calls made on an individual booking, which will force the steamship lines to reconsider their routes.

The fee is assessed at the first point of entry into the U.S., based on a vessel's net tonnage or discharged containers, whichever is higher. Shipping lines based in China such as COSCO and OOCL will be particularly affected.

CBP is working to finalize the payment system for the new fee and establish enforcement protocols. Vessels that do not settle their fees risk being barred from unloading cargo or denied departure clearance until payments are verified.

The fees will accelerate network changes, vessel redeployment, and calls for greater US-flag shipbuilding, although building globally competitive capacity in the US remains challenging for most operators.

The fees are intended to address China's maritime dominance and boost the U.S. maritime industry. There are fee exemptions for U.S.-owned vessels and U.S. exports.

FTZ Staff Activity

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-245-2025) in FTZ 21P on behalf of Zapp Precision Wire, Inc., Summerville, SC on July 25, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-246-2025) in FTZ 32 on behalf of Tecnotropolis, LLC, Doral, FL on July 29, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-247-2025) in FTZ 22 on behalf of TranSync International, Montgomery, IL on July 29, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-248-2025) in FTZ 281 on behalf of Newmed, Inc., Miami, FL on July 29, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-249-2025) in FTZ 50 on behalf of B.Y. International, Inc., City of Industry, CA on July 30, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-250-2025) in FTZ 89C on behalf of Coach Services, Inc., North Las Vegas, NV on July 30, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-251-2025) in FTZ 216 on behalf of All Season Power, LLC, Lacey, WA on August 4, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-252-2025) in FTZ 50 on behalf of Paramount Logistics, Inc., Lynwood, CA on August 5, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-253-2025) in FTZ 191 on behalf of Michaels Stores Procurement Company, Inc., Lancaster, CA on August 5, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-254-2025) in FTZ 126 on behalf of Go Direct America, Inc., Reno, NV on August 6, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-255-2025) in FTZ 18 on behalf of Unigen Corporation, Newark, CA on August 6, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-256-2025) in FTZ 135 on behalf of Viking Sport Cruisers - Florida, Inc., Riviera Beach, FL on August 7, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-257-2025) in FTZ 153 on behalf of VMA Company, Inc., San Diego, CA on August 7, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-258-2025) in FTZ 93 on behalf of U.S. Flue-Cured Tobacco Growers, Inc., Timberlake, NC on August 7, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-259-2025) in FTZ 281K on behalf of J.D. Brokers & Forwarding Company, Miami, FL on August 7, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-260-2025) in FTZ 22 on behalf of Accelerated Global Solutions Inc., Elk Grove Village, IL on August 7, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-261-2025) in FTZ 94 on behalf of UETA of Texas, Inc., Laredo, TX on August 8, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-262-2025) in FTZ 241 on behalf of Ferretti Group of America, LLC on August 8, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-263-2025) in FTZ 241 on behalf of Delta Industrial Systems Corp., Sunrise, FL on August 8, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-264-2025) in FTZ 114J on behalf of Horizon Hobby, LLC, Champaign, IL on August 8, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-265-2025) in FTZ 70 on behalf of RK Logistics Group, Inc., Whitmore Lake, MI on August 11, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-266-2025) in FTZ 22 on behalf of DM Merchandising, Inc., Elmhurst, IL on August 11, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-267-2025) in FTZ 17 on behalf of Honeywell International, Inc., Olathe, KS on August 15, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-268-2025) in FTZ 70 on behalf of Renaissance Global Logistics, Romulus, MI on August 15, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-269-2025) in FTZ 137 on behalf of Bender Warehouse Co., Winchester, VA on August 15, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-270-2025) in FTZ 38A on behalf of BMW Manufacturing Co., LLC, Greer, SC on August 15, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-271-2025) in FTZ 70 on behalf of IMRA America, Inc., Ann Arbor, MI on August 15, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-272-2025) in FTZ 230 on behalf of Dragon FTZ, LLC, Reidsville, NC on August 15, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-273-2025) in FTZ 26 on behalf of Radial, Inc., Locust Grove, GA on August 15, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-274-2025) in FTZ 26 on behalf of Expeditors International of Washington, Inc., Ellenwood, GA on August 15, 2025

- FTZ Board Staff processed a processed a Termination (S-275-2025) in FTZ 21M on behalf of Coastal Logistics, Inc., Summerville, SC on May 15, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-276-2025) in FTZ 84AK on behalf of Recodeal Energy Inc., Houston, TX on August 18, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-277-2025) in FTZ 84 on behalf of Q-Edge Corporation, Houston, TX on August 18, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-278-2025) in FTZ 176 on behalf of Medela LLC, Rockford, IL on August 18, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-279-2025) in FTZ 38A on behalf of BMW Manufacturing Co., LLC, Greer, SC on August 18, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-280-2025) in FTZ 202 on behalf of SBR Express, Inc., Ontario, CA on August 18, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-281-2025) in FTZ 193D on behalf of Intracom USA, Inc., Oldsmar, FL on August 19, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-282-2025) in FTZ 45 on behalf of Qorvo US, Inc., Hillsoboro, OR on August 19, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-283-2025) in FTZ 45 on behalf of Cornell Pump Company, LLC, Claskamas, OR on August 19, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-284-2025) in FTZ 52 on behalf of JPI Healthcare Solutions, Inc., Town of Islip, NY on August 21, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-285-2025) in FTZ 214 on behalf of Patheon Manufacturing Services, LLC, Greenville, NC on August 21, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-286-2025) in FTZ 126 on behalf of Dragonfly Energy Corp., Reno, NV on August 21, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-287-2025) in FTZ 50 on behalf of WAC Lighting Co., Ontario, CA on August 21, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-288-2025) in FTZ 204on behalf of Turtleson, LLC, Bristol, TN on August 21, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-289-2025) in FTZ 104 on behalf of Crane Worldwide Logistics, LLC, Port Wentworth, GA on August 21, 2025

- FTZ Board Staff processed a processed a Minor Boundary Modification (S-290-2025) in FTZ 53 on behalf of OBAE Solutions, LLC, Catoosa, OK on August 22, 2025

Foreign-Trade Zone Board Activity

-

- LMFAKRO, LLC withdrew its notification of proposed production activity for wooden attic stair products within Foreign-Trade Zone 20 in Elizabeth City, North Carolina. MORE

- Michaels Stores Procurement Company, Inc. received approval to operate their Hazleton, Pennsylvania facilities as Foreign-Trade Zone 24I. MORE

- PTubes, Inc. d/b/a Feinrohren PT received approval to operate their Waymart, Pennsylvania facilities as Foreign-Trade Zone 24J. MORE

- The McAllen Foreign Trade Zone Inc. submitted an application requesting authority to expand the service area of Foreign-Trade Zone 12 to include Willacy County, Texas. MORE

- Radix Group Int'l dba DHL Global Forwarding received approval to operate their Fort Worth, Texas facilities as Foreign-Trade Zone 196C. MORE

- A&K Railroad Materials, Inc. received approval to operate their Eagle Lake, Texas facilities as Foreign-Trade Zone 155E. MORE

- Mölnlycke Health Care submitted a notification of proposed production activity for medical dressings and foam within Foreign-Trade Zone 186C in Wiscasset, Maine. MORE

- General Electric Company received approval to operate their Peebles, Ohio facilities as Foreign-Trade Zone 46N. MORE

- CODEZOL, C.D. submitted an application requesting authority to expand Site 1 of Foreign-Trade Zone 163 to include an additional 93.91 acres, and removal of Site 6 in Ponce, Puerto Rico. MORE

No Cake And Ice Cream Yet:

It was another month of dynamic trade developments for the foreign-trade zone community. While there is cause for optimism that trade terms will stabilize soon, too much remains unsettled to do any celebrating just yet.

Negotiations with China resulted in a temporary pause in the sky-high rates FTZs had been paying on their imports. But recent rhetoric from Washington suggests the pause won’t last past the 90 days of the agreement. If it even lasts that long.

The U.S. Court of International Trade ruled that the use of IEEPA to place a 10% additional tariff on all imports overstepped presidential authority. The IEEPA tariffs are still being collected until higher courts make a final ruling. The financial stakes are HUGE for both sides.

An investment deal in U.S. Steel prompted the doubling of Section 232 tariffs on imported steel and aluminum beginning this Thursday. Nothing on the table suggests those 50% rates will be reduced anytime soon. Zones need to prepare accordingly.

Foreign-trade zone applications are down. Way down. Staff losses at the Foreign-Trade Zones Board and the loss of the NPF status option appear to be taking their toll. Bonded Warehouse applications? Still overwhelming CBP in certain ports.